Overview

In 2025 and into 2026, Spain’s economy emerged as one of the strongest performers within the eurozone, outpacing many of its larger peers in overall gross domestic product (GDP) growth. As of late 2025, Spanish growth forecasts for 2026 ranged around 2.0 %–2.4 %, significantly above the eurozone average of approximately 1.4 %–1.5 % projected by European institutions.

Spain’s robust performance has both domestic and regional implications, influencing investor sentiment, fiscal policy, labour markets, and the broader trajectory of economic integration within the euro area.

Economic Background

Since the early 2020s, Spain has benefited from a combination of strong domestic demand, job creation, tourism rebound, investment inflows, and structural reforms that have supported sustained GDP expansion. In 2025, growth hovered near 2.9 %, and official forecasts continued to anticipate above-average expansion into 2026.

Despite global economic headwinds, including softened external demand and rising trade tensions, Spain maintained dynamic economic activity, supported by real income gains, investment associated with EU Recovery funds, and a resilient labour market.

Spain’s Growth Relative to the Eurozone

Spain’s relative outperformance by late 2025 and into 2026 stands in contrast to slower growth in key eurozone economies such as Germany, France, and Italy. In broad macroeconomic forecasts, the euro area was expected to grow at a more modest pace (around 1.4 % in 2026), reflecting weaker external demand and structural headwinds.

This divergence underscores Spain’s growing importance within the eurozone growth dynamic:

- Contribution to Aggregate Growth: Spain’s higher growth rate contributes positively to the overall eurozone GDP aggregate, partially offsetting slower expansions in other member economies.

- Investor Confidence: Strong growth prospects have improved investor sentiment in the region, with surveys indicating lifted confidence among eurozone investors in early 2026.

Structural Drivers of Growth

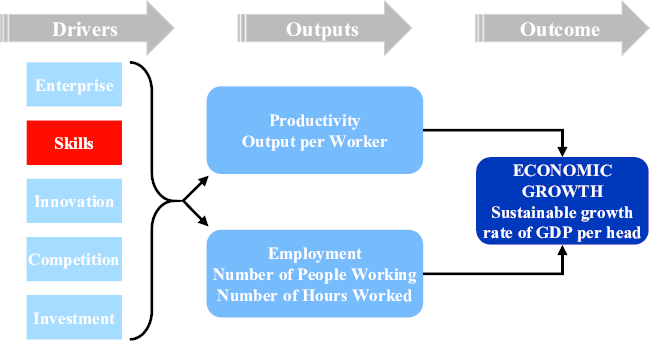

Spain’s economic momentum in 2026 was supported by several structural factors:

- Domestic demand remained the primary engine of growth, with robust private consumption and investment.

- Labour market dynamics continued to strengthen, with employment growth and rising real incomes supporting household spending.

- EU funds and public investment under the Recovery and Resilience Facility played an ongoing role in supporting infrastructure and productivity-enhancing projects.

- Sectoral diversification, particularly in services and higher value-added industries, helped sustain momentum even amid weaker goods exports.

At the same time, persistent challenges such as moderate productivity growth and external demand fluctuations highlighted areas for policy attention.

Regional and Policy Implications

Spain’s strong growth has several implications for the eurozone:

1. Fiscal Space and Policy Coordination

Spain’s relative outperformance expands fiscal room for manoeuvre, allowing policymakers to focus on structural reforms, fiscal sustainability, and targeted investment without the same level of austerity pressures faced by slower-growing members. At the EU level, these dynamics can influence debates over fiscal governance and cohesion policies.

2. Monetary Policy Context

While the European Central Bank (ECB) bases decisions on aggregate eurozone conditions, the resilience of high-growth members like Spain can temper inflation and output concerns, potentially shaping the timing and nature of monetary policy adjustments.

3. Labour and Migration Patterns

Strong Spanish growth has been accompanied by immigration inflows and job creation, contributing to labour market dynamism. These demographic shifts affect not only Spain’s economy but also broader labour mobility within the EU.

4. Economic Integration and Convergence

Spain’s performance highlights the heterogeneous nature of eurozone economies, reinforcing the need for policies that support convergence while respecting national contexts. It also offers a case study for how domestic policy, EU funding, and labour dynamics can collectively drive growth.

Challenges and Risks

Despite the positive outlook, structural challenges remain:

- External exposure: Spain’s growth is sensitive to shifts in global trade conditions and external demand.

- Productivity and competitiveness: Sustained long-term growth will require continued improvements in productivity and innovation.

- Fiscal sustainability: Maintaining a balance between growth-enhancing policies and prudent budget management remains a key policy focus.

Conclusion: Spain’s strong economic performance in 2025 and 2026 carries broad significance for the eurozone. It contributes to aggregate growth, bolsters investor confidence, and highlights the importance of structural reforms and domestic demand. While challenges persist, Spain’s relative trajectory offers important insights into economic resilience within the euro area and underscores the region’s diverse growth landscape

SpainEconomy #EurozoneGrowth #EuropeanEconomy #EU2026 #SpainGDP #EurozoneOutlook #EconomicGrowth #EURecovery #EuroArea #Macroeconomics #EuropeanUnion